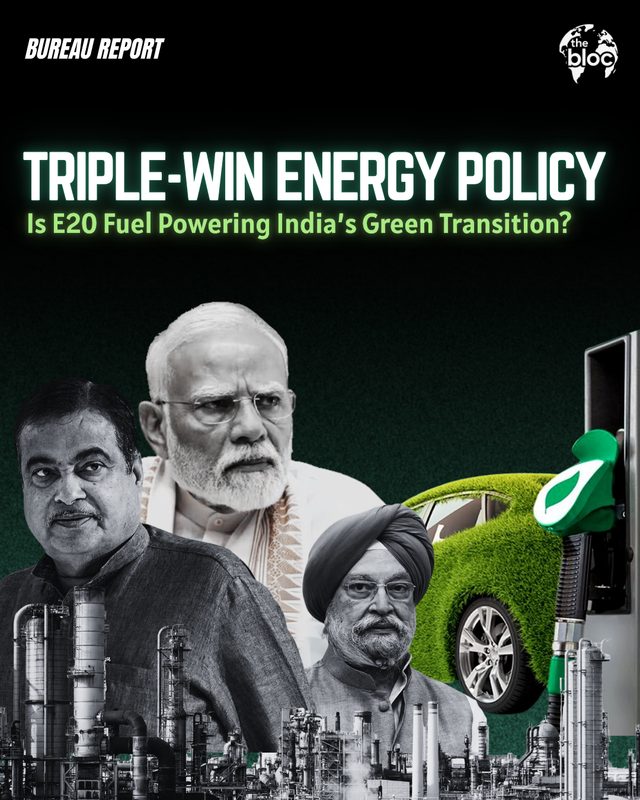

Have you ever wondered whether a single policy could reduce millions of tonnes of carbon emissions annually, cut a country's skyrocketing oil import bill and help farmers escape chronic payment arrears? This trinity might seem unreal to most countries. For India, it is the promise of the E20 ethanol blending programme. From a timid start of only 1.5% ethanol blending in 2013–14 to a splendid 19.05% in 2025, the journey represents a fundamental change in the intersection of energy, agriculture and climate policy. It helps Bharat take a quantitative leap by placing it at the forefront of global green transitions. E20 is more than just a bio-fuel strategy. It is a "triple-win" energy policy that profits farmers, environment and the economy.

How Did Bharat’s Ethanol Journey Evolve from Modest Beginnings to Bold Ambitions?

Early Foundations and Initial Struggles

When India started its ethanol blending initiative back in 2003, the goal was to introduce a 5% ethanol blending rate which later became known as the Ethanol Blended Petrol Programme. Hotfooting into this initiative, the early years saw a trivial 2-3% blending rate, mainly because the country couldn’t produce enough ethanol, didn’t have much in the way of feedstock and wasn’t offering enough financial incentives to farmers. Well-known structural problems in the programme were red tape. Irregular supplies and the problem of not all vehicles being compatible with the blended fuel really hindered the progress of the initiative.

The 2018 Policy Revolution

In India's biofuel journey, the National Policy on Biofuels 2018 marked a sea change. By expanding feedstock diversification to include B-heavy molasses, sugarcane juice, damaged food grains and excess rice from the Food Corporation of India, this all-encompassing policy framework drastically altered the ethanol scenario. The policy created a differential pricing mechanism with administered rates, making ethanol made from B-heavy molasses (₹47.49 per litre) and sugarcane juice (₹59.48 per litre) more expensive than C-heavy molasses (₹37.61 per litre). This created strong financial incentives for sugar mills to switch to producing ethanol.

The Cabinet Committee on Economic Affairs moved the E20 target from 2030 to 2025 in December 2020, marking the most important change in policy. Given the unstable world oil prices and India's growing import bill of $137 billion in FY25, the government's increasing faith in the program's potential and urgency regarding energy security issues was reflected in this five year acceleration. The program has become essential to India's larger vision of Atmanirbhar Bharat (self-reliant India).

The success of the program is a result of strong institutional coordination between several ministries, including Food & Public Distribution, Heavy Industries, Road Transport & Highways and Petroleum & Natural Gas, all within the supervision of NITI Aayog. By facilitating ₹41,000 crore worth of ethanol capacity additions through creative escrow mechanisms, the formation of tripartite agreements between sugar companies, banks and Oil Marketing Companies (OMCs) has revolutionized financing.

The Triple-Win Framework

Lifeline for Bharat’s Farmers

The ethanol programme has emerged as a game-changer especially by addressing the chronic problem of sugarcane surplus along with mill payment arrears for India’s agricultural sector. India’s sugar mills made around 320 to 360 lakh metric tonnes yearly which is much more than the 260 lakh metric tonnes domestic demand. Mill finances were certainly tied up by this persistent surplus and as a result payments for farmers were often delayed. The ethanol diversion mechanism has addressed this challenge systematically. This mechanism went from diverting 3.37 lakh metric tonnes of sugar to ethanol in 2018-19 to a projected 60 lakh metric tonnes by 2025.

The financial Impact has been transformative. Sugar mills have produced over ₹48,573 crore in revenue from ethanol sales over three Ethanol Supply Years, vividly improving their liquidity position. More importantly, cane payment clearance has improved exceptionally from 97.40% clearance in 2021-22 to over 99% in recent years. The programme has facilitated payments exceeding ₹1,25,000 crore to farmers between 2014-15 and July 2025, with expectations of ₹35,000 crore annually at full E20 implementation.

In addition to sugarcane, the programme has boosted the production of ethanol from grains, directly benefiting maize farmers as prices for the grain have nearly doubled, rising from ₹12–14 per kg to ₹23–24 per kg. This has helped the government reach its goal of doubling farmers’ incomes and opened up new markets for smallholder farmers.

| Metric | Value (₹ Crore or Lakh Metric Tonnes) | Description |

|---|---|---|

| Foreign Exchange Savings (₹ Crore) | 1,44,000 | Savings by substituting crude oil imports |

| Farmer Payments (₹ Crore) | 1,18,000 | Payments to sugarcane growers and distilleries |

| CO2 Emission Reduction (Lakh MT) | 698 | Estimated reduction in CO2 emissions due to ethanol use |

| Crude Oil Substitution (Lakh MT) | 244 | Amount of crude oil replaced by ethanol blending |

Pro-Environment Credentials

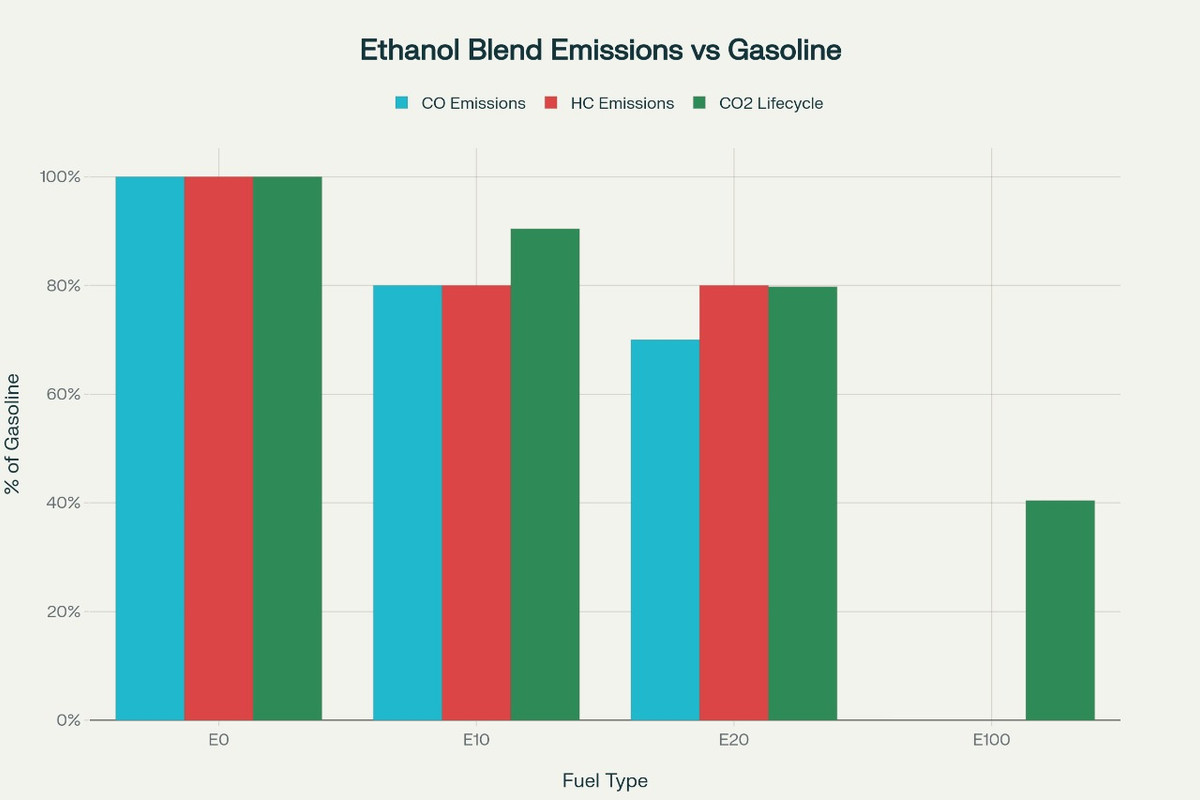

Extensive lifecycle assessments and emission studies validate the environmental benefits of ethanol blending. There is substantial potential for reducing pollution, according to research conducted by the Automotive Research Association of India (ARAI). When compared to pure gasoline, E20 fuel lowers carbon monoxide emissions by 30–50% for four-wheelers and up to 50% for two-wheelers. All vehicle categories see a 20% reduction in hydrocarbon emissions while also maintaining or improving performance metrics.

According to NITI Aayog, complete E20 implementation could result in 37 million tonnes of CO₂ equivalent greenhouse gas savings annually. Through July 2025, the initiative has already helped reduce carbon emissions by 736 lakh metric tonnes. According to lifecycle evaluations, ethanol made from sugarcane emits 30–50% fewer emissions than petroleum, and second-generation (2G) ethanol made from agricultural residues is expected to have even bigger advantages.

The programme also tackles India’s air quality issues, especially in the cities where vehicles are the greatest contributors to PM2.5 and ozone formation. Research indicates that the ethanol-blending will decrease the level of particulate matter and the increased octane of ethanol (typically 100-105 in E100) will allow the engine to work more efficiently.

The Economic Promise of E20

The economic justification of E20 is quite strong; when looking at the vulnerabilities of the Indian energy security. Since the imports of crude oil constitute 85 percent of the consumption and cost the country $137 billion a year, each percentage point of ethanol-blending would result in huge foreign exchange savings. By replacing 244 lakh metric tonnes of crude oil the programme has so far saved ₹1.44 lakh crore in foreign exchange until July 2025.

As a projection, with the successful implementation of E20, it will save an amount of $4-5 billion every year in terms of import, which amounts to 30,000-35,000 crore in ₹. This import replacement has strategic implication other than cost saving as it lessens the susceptibility of India to geopolitical shocks in the oil supply channels and offers the domestic consumers price stability.

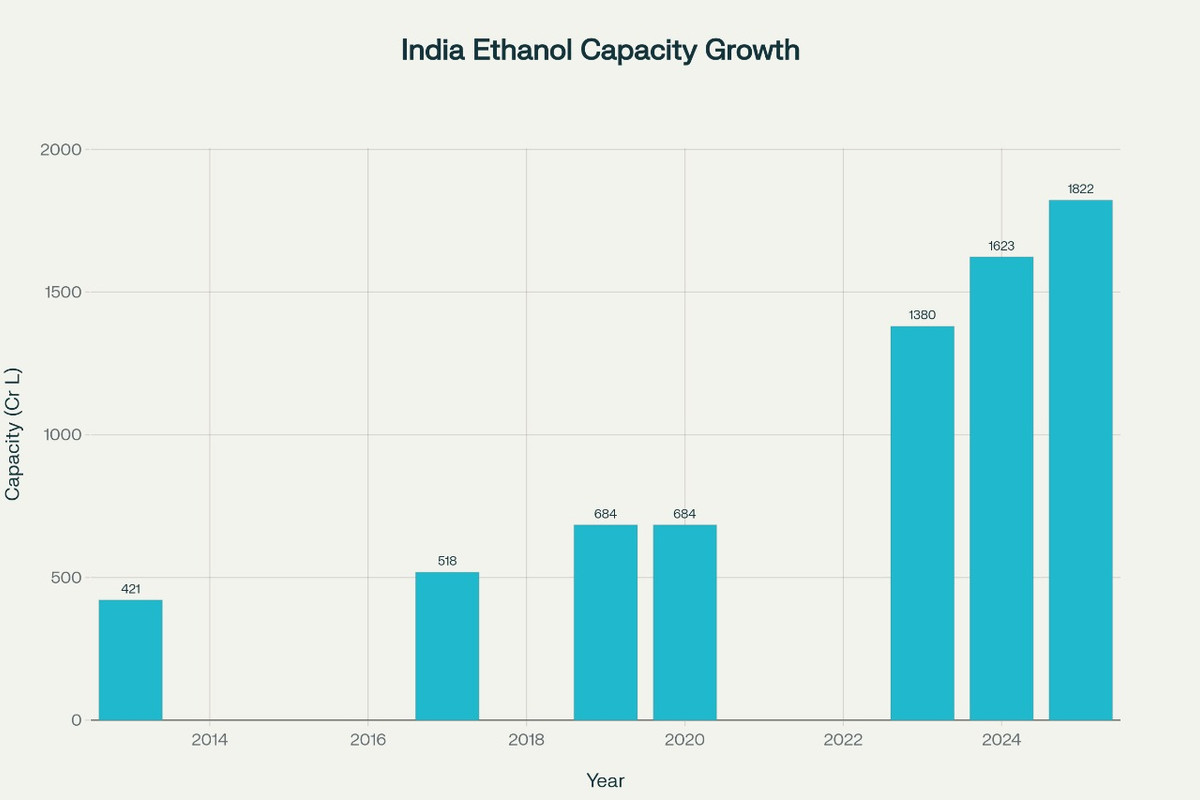

The programme has spurred the large-scale rural industrialization whereby the capacity to produce ethanol is projected to grow by 421 crore litres in 2013 to 1822 crore litres in 2025. This infrastructural project has resulted in employment in the value chain: every crore litre of ethanol produced has a local impact of creating around 290 direct and 1280 indirect jobs within the agricultural and other related industries. The overall employment effect is above 5 lakh jobs mainly in the rural regions.

| Year | Ethanol Blending Percentage (%) | Ethanol Supplied (crore litres) |

|---|---|---|

| 2013-14 | 1.5 | 38 |

| 2018-19 | 5.0 | ~150 |

| 2020-21 | 8.17 | 302.3 |

| 2022-23 | 12.06 | >500 |

| 2023-24 | 14.6 | 545 |

| 2025 (Target Achieved) | 20.0 | 1000+ |

Evidence-Based Implementation Assessment

Distillery Infrastructure and Investment Momentum

There has been unprecedented growth in the physical infrastructure that sustains E20 integration. By June 2025, there are 499 distilleries in India with a total annual capacity of 1822 crore litres, including 816 crore litres of molasses-based and 858 crore litres of grain-based and 136 crore litre of dual-feed plants. This can be described as a 332 percent upsurge compared to the 2013 figures which show an impressive momentum of confidence and investments in the private sector.

In the agricultural regions, there is strategic concentration in regard to regional distribution. The north has a command of 39 percent of total capacity making the region a key to its strong ground due to its strong agricultural base especially in states such as Uttar Pradesh, Punjab and Haryana. Such geographic distribution is consistent with availability of feedstock and economics of transportation.

The investment flows have been high as it has poured in more than ₹40000 crore in ethanol projects till 2025. The interest subversion scheme of the government, which grants 6% interest subversion or half of bank interests, whichever is less has played a major role in mobilizing the private capital to expand capacity.

Retail Infrastructure and E20 Availability

The distribution of E20 fuel has increased at a high rate in the Indian retail network. More than 15,600 retail outlets currently sell E20 petrol, in comparison with 27,900 outlets selling ethanol-blended petrol in 2014. OMC investments in ethanol-compatible storage and dispensing equipment has facilitated this infrastructure expansion but there are still some issues with consistency of blend quality across the country.

A change in logistics to full ethanol-blended fuel availability, while all the retail outlets sold pure gasoline in 2014, is a proportional logistical feat. Oil Marketing Companies have invested in special storage tanks, dispensing units and quality control systems that are ethanol-compatible to ensure fuel integrity in the supply chain.

Vehicle Manufacturer Readiness and Technological Adaptation

The automotive sector has reacted to the implementation of E20 quite favorably albeit with critical limitations. The E20 compatible vehicle availability has been assured by the Society of Indian Automobile Manufacturers (SIAM) in accordance with the timelines of fuel rollouts. Since April 2023, manufacturers started to produce E20 material-compliant and E10 engine-tuned vehicles that can run on 10-20% ethanol blends without compromising on optimal performance on E10 fuel.

However, the transition discloses important technical challenges. ARAI studies show fuel efficiency reductions of 6-7% for four-wheelers originally designed for pure gasoline (E0), calibrated effect for E10 and 3-4% for two-wheelers. In regards to vehicles designed for E10 and calibrated for E20, efficiency losses are more modest at 1-2%. The findings emphasize the significance of holistic optimization of the design of the vehicles for ethanol blending.

Judicial Validation and Policy Legitimacy

The legal basis of the programme has been strengthened by judicial confirmation. Courts have dismissed various Public Interest Litigations that would question ethanol blending requirement and has noted the reason why the government should promote the use of renewable fuels in the framework of energy security and environmental conservation. This judicial support brings key legitimacy and sustainability guarantee on long-term investments in ethanol value chain.

Implementation Challenges:

Fleet Compatibility and Consumer Concerns

The most apparent implementation issue is the current vehicle fleet of India where approximately 70% of vehicles are pre-2023 models not designed for E20 fuel. According to consumer reports, non-compliant vehicles have lost mileage of 10-20 percent and there have been fears of accelerated components wear and that the potential damage to engines. Such issues have caused a great amount of social discussion and need transparent communication with corrective actions.

Field experiences vary considerably. In other instances such as 2019 Volkswagen Vento, some consumers complain of significant mileage reductions from 11-12 kmpl to 7-8 kmpl. Some experience more modest impacts. The difference between the laboratory results (1-6 percent efficiency loss) and the field experience (up to 20 percent in certain cases) imply that more thorough field experimentation and consumer education should be executed.

The automobile sector suggests that parallel availability of E10/E0 should be kept throughout the transition to avoid harming the existing vehicle owners. This necessitates vigilant supply chain management and spreading awareness about the apt fuel choice for different vehicle categories.

Sustainability Concerns

Ethanol production in India still relies mainly on sugarcane-based feedstocks (around 80%), which raises sustainability concerns because sugarcane requires a large amount of water. Producing one litre of ethanol requires about 2,860 litres of water and sugarcane farming alone consumes nearly 70% of India’s total irrigation water alongside paddy. This heavy reliance makes them highly vulnerable to climate fluctuations and raises serious concerns about long-term environmental sustainability.

These vulnerabilities are depicted by the 2023 experience. It resulted in 55 million tonnes sugarcane crop cuts and 4 million tonnes kharif rice cuts culminating in the unavailability of ethanol feedstock. Climate risks will increase in nature and this necessitates increased diversification to less water-intensive feedstocks such as maize and second generation sources.

The present production of grain-based ethanol, however, increasing, has a set of challenges. The shortage of maize has led the manufacturers to compete over the scarce stocks of surplus maize by creating supply bottlenecks. The widening gap between rising MSPs of maize and rice and the stagnant ethanol procurement price threatens the financial viability of grain-based ethanol production.

Consumer Awareness

The programme has low awareness of the E20 benefits among the people, the compatibility requirements of the vehicle, and when to use it. The ethanol blending levels in fuel stations are also unknown to many consumers since very few stations show the blend information in highly noticeable places. This information asymmetry adds to consumer anxiety and opposition to increased blending of ethanol.

Communication plans need to reach a variety of audiences. Message to be communicated to the owners of vehicles, fuel retailers and the general population should be customized to show them the economic, environmental and performance advantages of blending in ethanol.

Comparative International Lessons

Brazil's Flex-Fuel Success Model

The ethanol programme in Brazil provides the best international template to India. It has realized 46% average ethanol share in transportation by a mix of compulsory blending (27 percent) and voluntary E100 adoption by flex-fuel vehicles. The success of Brazil can be attributed to some major factors which can be applied directly to the circumstances in India.

First, Brazil adopted a gradual change strategy spread out over decades. E10 and E20 variants were started from 1976, mandatory E20 since 1993, mandatory E25 from 2007 and introduction of flex-fuel vehicles since 2003. Such a steady transition enabled the consumers and industry to adjust in a systematic and orderly way. Second, Brazil ensured consumer choice through the differentiation of prices of blended and pure ethanol. E25 is about 50 percent more expensive than E100. Hence, promoting voluntary adoption of higher ethanol content.

Third, flex-fuel cars now dominate more than 90 percent of new car sales in Brazil due to the advanced technology and positive economics. Consumers’ inclination to move toward higher ethanol blends is largely driven by the price difference between blended gasoline and ethanol.

In the case of India, it can be argued based on the experience of Brazil which includes the introduction of flex-fuel vehicles alongside the implementation of E20, that it is vital to have fuel choice in the transition period and to create the mechanisms of pricing that will motivate the consumers to go with increased ethanol uptake.

USA’s Renewable Fuel Standard & Food-Fuel Dynamics

The U.S. renewable fuel standard requires 15 billion gallons of corn, ethanol yearly. This offers information on the high-scale challenges of biofuel implementation. The U.S. experience highlights admonitory lessons about food-fuel competition, trade-offs and economic effects on the environment.

The growth of corn ethanol in the U.S. led to the cultivation of 6.9 million more acres of corn between 2008-2016 but with the effect of soil degradation, water pollution and loss of biodiversity. Research shows that corn ethanol can be 25 percent higher in carbon intensity than gasoline taking into consideration land-use changes. Moreover, ethanol policies also led to 21 percent of corn price upsurge that created food security issues in the world arena as well.

The lessons to India are about the need to diversify feedstock and focus on lifecycle assessment and pay heed to the implications of the food security as the programme increases in size.

Path Forward:

Development of 2nd Gen Ethanol

India needs to speed up the rollout of 2G ethanol so as to mitigate the issue of sustainability and feedstock. There has been some first steps made in the country with the opening of the first 2G ethanol plant in Panipat, Haryana to process rice straw and produce 30 million litres of ethanol a year. Six commercial 2G plants and four demonstration facilities are authorized within the Pradhan Mantri JI-VAN Yojana, which holds a lot of promise regarding the use of agricultural residues.

The several benefits of using 2G ethanol are that it uses the residues of crops that would otherwise be burnt (which leads to air pollution), the method uses less water than the traditional sugarcane production and it also gives the farmers other sources of income. Research has shown that electricity production from rice straw yields the highest global warming potential benefits (1471 kg CO₂ equivalent), followed by biogas (730 kg CO₂ equivalent) and ethanol (521 kg CO₂ equivalent).

There are however technological and economic challenges of 2G ethanol. Its production costs is higher than those of first-generation ethanol, underscoring the need for further technological advancement and economies of scale. The government must take into consideration increased financial incentive on 2G ethanol production and research and development partnership with technology provider companies such as Praj Industries.

Consumer-Centric Transition Strategy

Based on the experience of Brazil, India should adopt a consumer friendly transition strategy, which will not restrict its fuel option in the time of adjustment. This involves not only the availability of E10 as a protection fuel to older vehicles but the increased availability of E20 to compatible vehicles. Labelling at the fuel depots, educating the consumers on compatibility of the vehicles and transparent communication about the effect on the mileage are imperative.

Tax incentives on the E20 fuel should be considered by the government to compensate the efficiency losses for consumers using non-optimized vehicles. Price incentives creating a comparative advantage of the ethanol-blended fuels over gasoline per se will facilitate voluntary up-take and mitigate opposition to the transition.

Flex-Fuel Vehicle Ecosystem Development

Flex-fuel vehicles should be adopted by India on a long-term basis to realize greater usage of ethanol. Existing GST rates on flex-fuel vehicles should be aligned with electric vehicles (5%) rather than conventional vehicles (28%) to boost adoption. Such alignment of the policy acknowledges the environmental advantages of flex-fuel vehicles and facilitates the overall clean energy shift.

Efforts should also be encouraged to persuade automotive manufacturers to come up with cheap flex-fuel models in both four-wheelers and two-wheelers. The price premium of flex-fuel capability (₹17,000-25,000 for cars, ₹5,000-12,000 for motorcycles) needs to be managed by subsidies or tax concessions in the early stages of the market development.

Integrated EV-Ethanol Strategy

Instead of considering the electric vehicles and ethanol blending as competing strategies, India needs to focus on an integrated policy to use both the technologies to serve various market segments as well as user cases. In the short term, ethanol blending in the existing internal combustion engine fleet delivers immediate benefits to urban areas, while in the long term, electrification through EVs is expected to transform urban transport.

This mixed methodology comes into terms with pragmatism. The changes towards EV will be sluggish because of infrastructure, cost and consumer preference whereas ethanol blending can provide instant environmental and economic effects to the existing car fleet. Strategies should bring into line the technologies with their most suitable applications. For example, electric vehicles for urban commuting and ethanol-blended fuels for long-distance, heavy-duty and rural transport.

Monitoring and Evaluation Framework

Establishment of good monitoring systems to track the environmental gains, economic gains and implementation difficulties is essential for optimization of the programme. Mileage effects, emissions advantages and long-term vehicle performance with various ethanol mixtures should be verified through independent testing facilities. Adaptive management and constant improvement will be ensured by regular stakeholder feedback mechanisms that will engage the farmers, consumers, automotive manufacturers and environmental groups.

The government must release a report on annual progress on blending with accessible information on the attained successes, economic effects, environmental gains as well as the implementation difficulties. Such transparency will grant trust to the population and help make evidence-based policy modifications.

Conclusion

E20 ethanol blending programme of India is one of the most effective and proactive renewable energy policies of any developing country. The quantitative performance is spectacular. The blending of ethanol rose to 19.05 percent in 2025 as compared to 1.5 percent in 2013-14, capacity to blend rose to 1822 crore litres and economic benefits of over ₹1.44 lakh crore as a form of foreign exchange savings. More to the point, the programme has proved to be capable of integrating large scale renewable energy and at the same time, provided simultaneous benefits to farmers, environment and national energy security.

Several important factors contributing to the programme’s success also offer valuable lessons for sustainable development. Whether it was extensive involvement of stakeholders in the agricultural sector, industry or the motor industry, policy design that was able to flexibly adapt with a humble start to ambitious goals, new financing mechanisms that attracted the influx of private investment and reliable political leadership that kept the process going despite challenges during implementation.

The success of the programme in the long run however hinges on the ability to deal with fundamental transition issues, especially, the compatibility of fleet of vehicles, the sustainability of feedstock and its acceptance by consumers. The two issues of early adopters reporting reduced mileage and the excessive reliance of the programme on water-intensive sugarcane need to be addressed immediately with technological improvements, feedstock diversification and open communication with consumers.

In prospect, India’s E20 programme holds the potential to position the country as a global model for fuel transition in developing nations, should it overcome its current implementation hurdles and transform it into a more diversified and technologies-neutral strategy. The adoption of second-generation ethanol, flex-fuel and complementary electric vehicle roll-out will define whether E20 will be a lasting aspect of the Indian energy scene or a de-facto step toward full electrification.

Having made the right course corrections, the E20 programme in India can actually prove to be the most promising green energy policy that would strike the right balance between economic growth, environmental conservation and energy security in the most populated democracy in the entire world. The ultimate success of the programme will not only be quantified by percentage attainment but also in effect to the overall sustainable development desired of India and how it can be repeated in other developing countries where energy and environmental issues are a common problem.

Kartik Rajbhar

is enrolled in 4th year with the Department of Political Science at Hindu College, University of Delhi. He is passionate about governance, diplomacy and international relations. Actively engaged in political discourse, he blends academic curiosity with a keen focus on policy analysis. A history buff too at heart, he draws inspiration from the past to decode the present.

Resources

- ET Report: Ethanol blending at 19.05% in July 2025; ₹1.44 lakh cr forex saved

- NITI AAYOG ROADMAP FOR ETHANOL BLENDING IN INDIA 2020-25

- Vision IAS Current Affairs Ethanol Blending

- PIB Release: Establishment Of Bio-Ethanol Plants

- PIB Release: Centre encouraging sugar mills to divert excess sugarcane to ethanol

- Business Standard Report: Ethanol blending saved foreign exchange worth Rs 1.08 trillion since 2014

- ET Insights: Grain-based ethanol: Fuelling India’s energy transition and rural economy

- Garg, D. S., & Singh, M. R. (2025). Experimental Evaluation & Analysis for the Biogenic Content of Ethanol-blended Gasoline using Accelerator Mass Spectrometry (AMS): Paper No. 2025-DF-01. ARAI Journal of Mobility Technology , 5 (2), 1501–1515.

- State-wise details of ethanol distilleries, annual production capacity, and ethanol supplied during ESY 2021-22 to 2024-25

- Deccan Herald Report E20: Green Fuel and Red Flags

- TOI Report: E20 Rollout Sparks Consumer Concerns

- The India Forum: Challenges in Meeting Ethanol Fuel Blending Target by 2025-26

- The Indian Express Report: Mileage woes, engine damage worries: As E20 fuel blend sparks off backlash, Brazil’s calibrated approach offers a template

- Food & Water Watch: How Ethanol Worsens the Worst Parts of Our Food System

- Advanced Biofuels: The Big Launch, PM Modi Inaugurates India’s First 2G Ethanol Project, Using Praj Technology

- Pooja Saluja, RAJAR Volume 11 Issue 08 August 2025